What is ESG?

As younger generations become more and more involved in investment and high-level corporate decision-making, the majority of these choices are made with their personal values at the forefront. For this exact reason, companies have begun to heavily invest in creating and meeting ESG related goals.

By 2020, over $17 trillion in ESG-conscious investments and assets were held by professional funds, up from $12 trillion just two years prior.

The term “ESG” is thrown around a great deal, but what exactly does it mean, and how can it be a measure of operational efficiency and success?

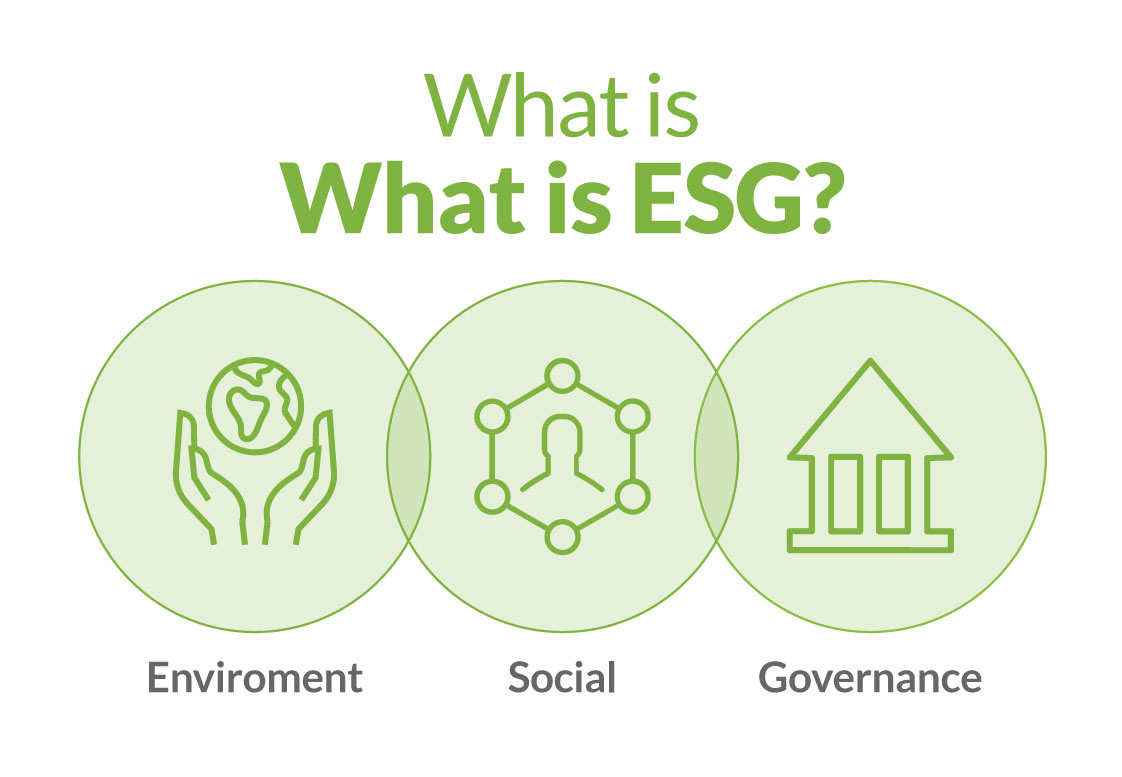

What is ESG?

Environmental, Social, and Governance (ESG) benchmarks are a set of standards focused on enterprises’ socially and environmentally conscious operations used as a litmus test for potential investors.

From the organizational standpoint, ESG goals are a standard by which they can seek to optimize and streamline their operations while discovering and removing inefficiencies and reducing needless costs.

Let’s break down these guidelines down further:

Environmental – How does the organization address its carbon footprint, sustainable business practices, supply chain and partnerships?

Social – How does the organization manages its relationships with employees, shareholders, clients, partners, and their relationship with the community they are operating in?

Governance – How does the organization organize its executives, their pay structure, shareholder rights, periodic audits, and internal financial controls?

These three criteria are weighed and then compared to other organizations within and outside of your sector to come up with an ESG Score or Rating.

How do you calculate an ESG Score?

An ESG Score is a numerical aggregation of the above criteria used to calculate and track how organizations meet their set ESG goals. The challenge in calculating an accurate score is that each organization uses its own formula and methods used to quantify its performance.

Without any true standardization, and with current solutions lacking the comprehensive ESG data needed to provide reliable ratings, a lot more needs to be done. To start, organizations can agree to use universal benchmarks like MSCI and the Sustainability Accounting Standards Board (SASB) frameworks for ESG reporting.

You also need to ensure you are tracking relevant and valuable metrics that can give an accurate look at your organization’s ESG profile, so let’s take a quick look at some of the metrics you can track.

What are some ESG metrics you can track?

One leading score system was created by MSCI, which takes a number of metrics to test and measure an organization’s resilience towards ESG-related risks. Broken down into three main categories of laggard, average, and leader, the system is relied upon by over 8500 companies and nearly 700,000 funds and other equities.

In terms of the environmental score, besides carbon emissions and your product carbon footprint, the MSCI ESG Score also examines your material and water sourcing along with land use. This also includes the waste from your operations and your product lifecycle, along with e-waste, among others.

Taking a look at the social aspect, this is all about labor management, onboarding practices, safety regulations, and supply chain transparency. This score also takes into account product liability like quality control, product safety, investment practices, and data security. Social also includes community relations, and access to welfare like nutrition and health, healthcare, communication, and finance.

Finally, in terms of governance, these metrics are all about corporate behavior and executive practices, board diversity, and financial transparency. With the metrics established, let’s address why organizations should start caring about their ESG performance for more than just investors.

Why is ESG so important?

As the pandemic turned global business on its head, industries realized changes needed to be made in terms of achieving more sustainable and efficient operations. Various climate summits like COP26 have convened and made lofty goals for us to achieve, the onus for these changes is not just on governments, but businesses as well.

All of these changes have made decision-makers and investors much more conscious of these issues.

The UN-led Portfolio Decarbonization Coalition, with 32 countries holds over $3 trillion in assets. They alone have committed more than $800 billion of that to fund green projects and investments, soon crossing $1 trillion. Moreover, several international regulatory bodies are in the process of creating robust ESG regulations and policies focused on global adaptation.

However, ESG isn’t just about high-level economics and political endeavors. Customers are waking up to how the companies producing the products and services they rely on conduct business and how aware they are of their environmental and social impact.

But how do these organizations benefit in the end from investing in creating and achieving ESG goals?

Maintaining a high ESG score will first and foremost help your bottom line. Optimizing your processes and equipment and having the ability to remotely monitor and manage those assets is an integral part of this.

To achieve this, you need an overarching overview of your remote facilities and assets and track their energy use and carbon emissions. An RMM solution like Galooli’s is a perfect solution to help you implement your ESG strategy while optimizing efficiency and sustainability across your remote sites and facilities.

For this reason, companies of all sizes need to start making efforts now instead of later, because ESG standards are here to stay.

ESG for businesses big and small

While ESG may seem like a guideline focused on larger enterprises and organizations, it is just as relevant for smaller operations as well. In the case of enterprises and larger businesses, we’ve established the importance in terms of investments, in addition to operational efficiency and sustainability.

It also fuels financial growth and many studies have found that higher-performing ESG companies are much less volatile and the workforce significantly more productive. They also dealt with fewer regulatory and legal pitfalls along the way and organization-wide cost reduction.

For smaller businesses and organizations, ESG goals can help with more effective decision-making, a more intimate relationship with their customers, and more flexibility in their operations. Things as simple as digital receipts, recyclable packaging, renewable energy use, and proper waste management are all integral parts of achieving ESG success for smaller organizations.